Electronic Funds Transfer Uses Technology For Banking Activities

National Electronic Funds Transfer or NEFT is the most commonly used online payment option to transfer money from one bank account to another. There is no maximum limit but this depends from one bank to.

What Is Mobile Internet Banking Benefits Services How To Register

This is to say with electronic banking it is even easier for a holding bank to control its subsidiary bank allocated at a distant as a result of technological improvement.

Electronic funds transfer uses technology for banking activities. Transfers can be initiated using online banking. Simply stated electronic funds transfer payments are payments completed over a computer network. We can use electronic funds transfer for.

However you can also transfer money to one or several financial institutions. The funds are transferred on a deferred settlement basis which implies that the money is transferred in batches. Usually salary transfers by companies are done using NEFT.

An electronic funds transfer EFT or direct deposit is a digital movement of money from one bank account to another. Information Technology has also provided banking industry with the wherewithal to deal with the challenges the new economy poses. Debit or credit card transactions.

Credit or debit card. SCHUCK Many of the nations bankers businessmen and banking regula-tors have a grand vision of the consumers future. An electronic funds transfer EFT allows payments between two parties via electronic signals.

This involves making payments through online banking systems. Just over the horizon they fervently hope is. These transfers take place independently from bank employees.

Cardholder-initiated transactions using a payment card such as a credit or. Electronic funds transfers Typically layers are created by moving money through electronic funds transfers into and out of domestic and offshore bank accounts of fictitious individuals and shell companies. These payments move between people and banks to.

Typical Uses of Electronic Funds Transfer. You may enroll in online banking to perform electronic transfers to external accounts. E-BANKING DEFINITION OF E-BANKING Electronic banking also known as electronic funds transfer EFT is simply the use of electronic means to transfer funds directly from one account to another rather than by cheque or cash.

As a digital transaction there is no need for paper documents. Electronic funds transfer EFT is the electronic exchange transfer of money from one account to another either within a single financial institution or across multiple institutions through computer-based systems. Online Banking External Funds Transfer.

Have your paycheck deposited directly into your bank or. This is a fast-growing mode of payment that is. A number of countries have well-developed offshore banking sectors.

You can make or receive payments via EFT within hours or even minutes making EFT. Electronic Funds Transfer Technologies and Services -Chapter Summary Electronic funds transfer EFT consists of a group of technologies that allow finan-cial transactions to be carried out electronically. Information technology has been the cornerstone of recent.

As businesses increase their usage. In some cases these banking. Electronic funds transfers began in the 1960s but became widespread in the 1970s with the introduction of the automatic teller machine ATM.

111 Definition of E-Banking Electronic banking known as Electronic Funds Transfer EFT it is basically the use of electronic methods or means to transfer money electronically directly from one account to another account rather than cash or cheque. You can use electronic funds transfer to. Similar to an ATM electronic money transfers can be initiated by phone using pay-by-phone systems.

Offshore banks These are banks that allow for the establishment of accounts from nonresident individuals and corporations. EFT helps in transferring the money electronically from a buyers account and into that of the seller. An electronic funds transfer can include things like.

Messages sent by several forms of tele-communication cause funds to be transferred from one financial account to another. Using EFT for banking can reduce the amount of time and money you spend paying expenses and receiving income. Personal Computing Banking online banking.

Wire transfer via an international banking network. 2003 cited by Wisdom 2012 E-banking refers to financial activities that involve use of electronic technology. The term covers a number of different concepts.

As this does not involve any human. EFT has become a predominant method of money transfer since it is a simple accessible and direct method of payment or transfer of funds. Online electronics banking mobile banking and internet banking are just a few examples.

As part of the latter is electronic funds transfers EFT also referred to as electronic bank transfers. This is probably the most popular form of EFT payment due to its convenience and flexibility. When you enroll you will be provided terms and conditions that apply to electronic transfers using our online banking services.

Electronic checks are similar to paper cheques but render payment only in electronic form using an EFT. Technology has opened up new markets new products new services and efficient delivery channels for the banking industry. Easily than it was in the past.

Citizens Community Bank sets limitations on daily and monthly transactions for your protection. A TECHNOLOGY IN SEARCH OF A MARKET PETER H. We can withdraw money by an ATM machine with a personal identification.

Online bill payments. For you to transfer money you would use a computer or smartphone. Online Banking Bill Payment.

That means you can move money around at will without any assistance from a banking. In simple terms this entails transferring money electronically from one bank account to another.

How Are Digital Banking Facilities Helping During Covid 19 Pandemic Global Trade Magazine

Electronic Banking Types Of Electronic Banking Services Paisabazaar Com

What Are The Most Common Mobile Banking Activities Mobility Banking Mobile Banking Check And Balance Banking

17 Advantages And Disadvantages Of An Electronic Funds Transfer Vittana Org

Electronic Fund Transfers Mycreditunion Gov

Https Www Oecd Org Competition Digital Disruption In Banking And Its Impact On Competition 2020 Pdf

Electronic Fund Transfer An Overview Sciencedirect Topics

Electronic Fund Transfer Act Efta Definition

The Payments Industry Landscape What Does It Look Like Today Cardknox

Difference Between Internet Banking And Neft With Table

News Bdounibank Rakbank Rakmoneytransfer Ripplenet Rakbank Uses Ripplenet To Improve Remittance Services Blockchain Technology Money Transfer Improve

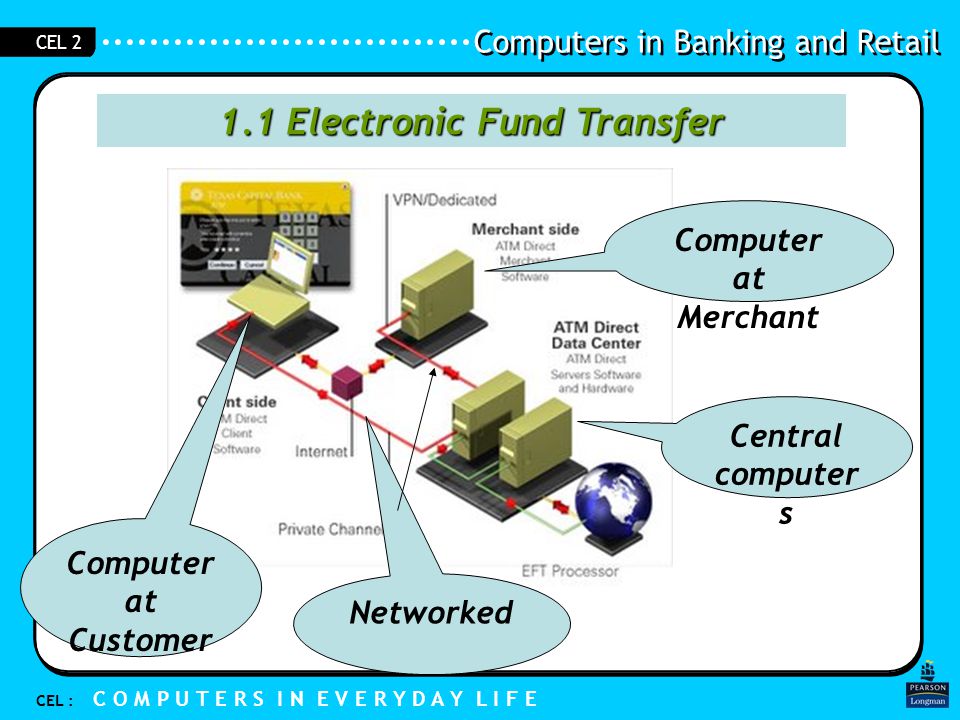

Cel Computers In Banking And Retail Ppt Download

Igcse Ict Banking Payment Systems Igcse Ict

What You Need To Know About Eft Electronic Funds Transfer In Canada Apaylo Ecommerce Payment Software Canada

What Is Internet Banking What Is E Banking

Electronic Fund Transfer Act Consumer Rights Protections

25 Best Finance And Banking Powerpoint Templates To Shape Your Future Transactions By Slideteam Medium

Mobile Banking Overview History Types Importance

Cel Computers In Banking And Retail Ppt Download

Post a Comment for "Electronic Funds Transfer Uses Technology For Banking Activities"