Electronic Funds Transfer Vs Direct Debit

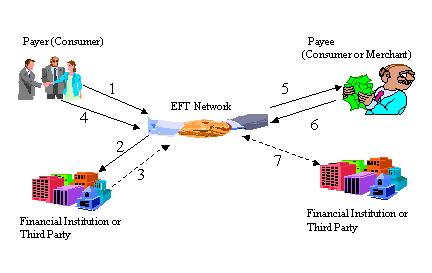

This is a general term for transferring money not by check. EFT stands for electronic funds transfer.

Ach Vs Wire Transfers Which To Use To Pay Employees

It occurs through a computer-based system without the need for direct intervention from an employee.

Electronic funds transfer vs direct debit. The term includes but is not limited to pre-authorized electronic funds transfers such as direct deposit of Social Security payments. Direct Deposits transfer funds from one account to another on a recurring basisThey are often used by businesses to pay salaries each month. The Electronic Funds Transfer comes into effect when paying bills or buying goods with a credit or debit card Summary.

With direct deposit or electronic funds transfer EFT the general public government agencies and business and institutions can pay and collect money electronically without having to use paper checks. The basis for collecting money is a signed authorization mandate given to the creditor by the debtor. An electronic fund transfer EFT on the other hand.

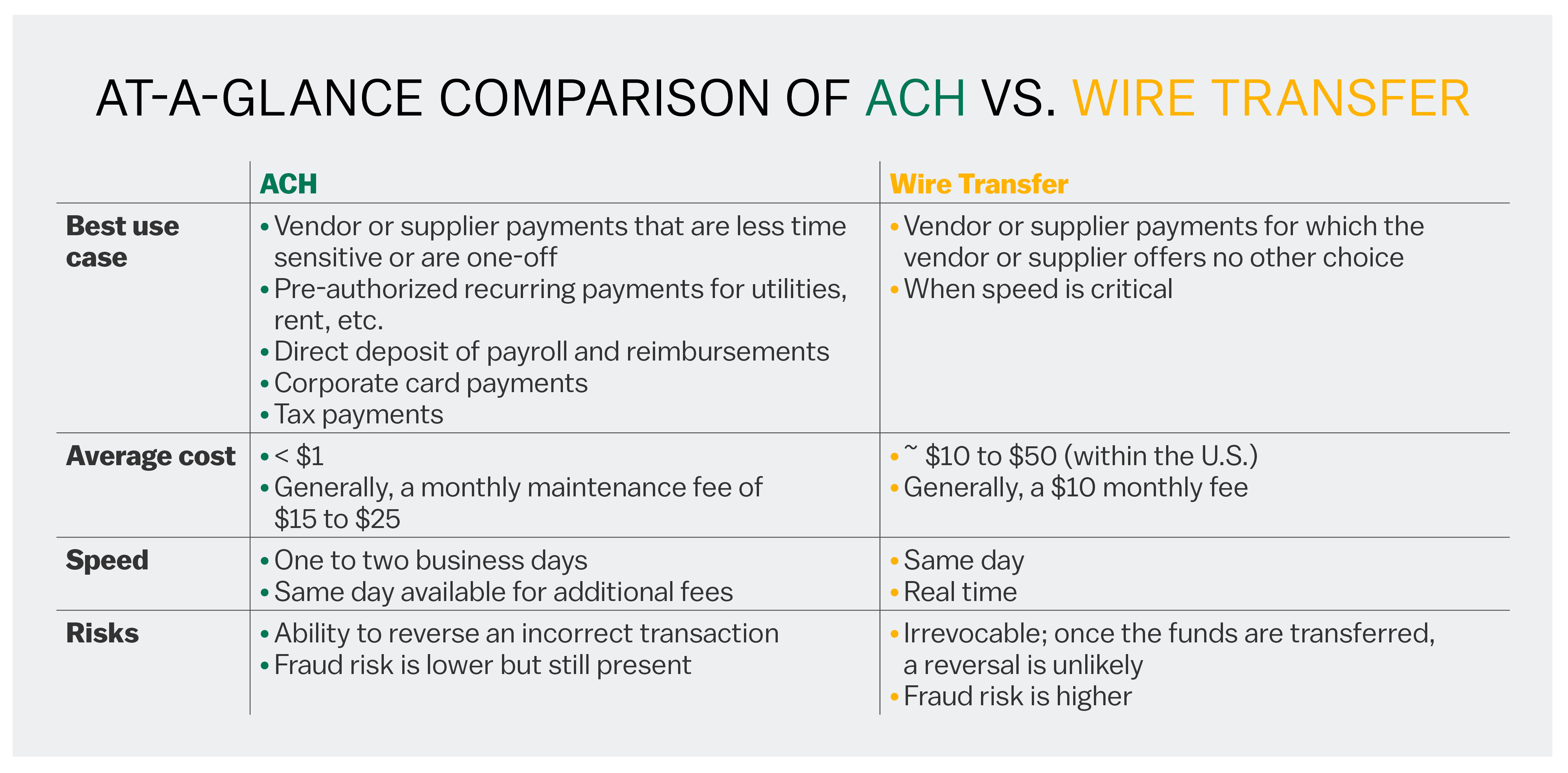

Wire Transfers are a quick and efficient way of sending a large amount of moneyThey are generally used for large one-off payments such as a deposit on a house. EFT can refer to a direct deposit. Like direct deposit its another kind of electronic money transfer but whereas direct deposit is most often used for recurring payments wire transfers are.

The most common use of EFT is a direct deposit of funds in the bank account electronically rather than issuing a pay-cheque. EFT is a general umbrella term that covers various electronic payments including but not limited to ACH transfers and wire transfers. Wire transfers are electronic transfers that take place between one bank and another or between commercial wire-transfer companies such as Western Union or MoneyGram.

It is done electronically and utilizes computer networks to transfer funds from one memberinstitution to another as a form of payment. Electronic Funds Transfer EFT Payments. How secure are wire transfers and EFT payments.

The most widely used form of sending money today is the Electronic Fund Transfer EFT. Direct deposit EFT is safe secure efficient and less expensive than paper check payments and collections. Electronic fund transfers EFT move funds from one bank account to another bank account either within the same financial institution or between two different banks.

Direct Deposit Electronic Funds Transfer is the electronic transfer of your paycheck benefit check or other payment into your checking share draft or savings account or other low-cost account offered by your bank. An electronic funds transfer is the electronic transfer of money from one account to another from within a single financial institution or across multiple banks or credit unions. ACH means Automatic Clearing House and EFT means Electronic Funds Transfer.

Electronic Funds Transfer mainly deals with transferring money from one account to another in an electronic way. SEPA Direct Debit SDD The SEPA Direct Debit enables consumers and businesses to make cross-border direct debit payments in EUR currency. Electronic Fund Transfer Act of 1978 defines EFTs as a transfer initiated by telephone computer.

Accounts may be held in any SEPA currency but the transfer of funds between them is always in euro. Recipients may pay a small set up fee and a nominal maintenance cost. Most banks and non-banking financial institutions have invested in superior technologies to help keep clients funds.

EFT transactions transfer money among banks or between banks giving businesses and consumers flexibility when making or receiving payments. Credit and debit cards payroll deposits of employees online bill pay. EFT is an Electronic Funds Transfer encompassing all electronic payments and including ACH payments.

A main difference is an EFT could be either a wire transfer or an Automated Clearing House transaction while a debit card refers only to a direct debt transaction. Its an umbrella term covering any sort of electronic transfer of money from one account to another which is done via a computer3 This could be a transfer of funds between two different accounts within one bank or moving money between banks - and even between banks in different countries3. Electronic fund transfer mechanism entails wire transfers direct debit online bill payment ATM withdrawals etc.

Electronic fund transfer is an umbrella term that can be used to cover all forms of transferring funds electronically instead of cash or check. Instead of receiving a check in the mail and taking it to your financial institution you can rest assured that your money is. An electronic funds transfer is a paperless transfer deducted from one account and almost immediately sent to another account.

The term does not include payments by check. It includes all types of transfers. EFT payments serve many purposes including customer billing collections and direct deposit payroll.

You can use this payment method for one-time charges or to deduct reoccurring charges such as monthly membership dues. Wire transfers - which are described in our brief. Unless otherwise stated most direct debits do not attract any charges to the sender.

ELECTRONIC FUNDS TRANSFER Means any transfer of funds that is started through an electronic terminal or magnetic tape for the purpose of ordering instructing or authorizing us to debit or credit your account. EFTs include credit card online and mobile payments in addition to direct deposits and wire transfers. Electronic Funds Transfer commonly known as an EFT is a type of ePayment.

EFTs are becoming increasingly widespread with the advancement of B2B payments with both big and small businesses moving away.

Ach Vs Wire Transfers What S The Difference Quickbooks

Ach Vs Wire Transfer Comparison Faqs Avidxchange

A Comprehensive Guide To Eft Payments Electronic Funds Transfer Payment Depot

Wire Transfer Vs Online Transfer Key Differentiators Remitr Blog

What Is An Eft Payment Gocardless

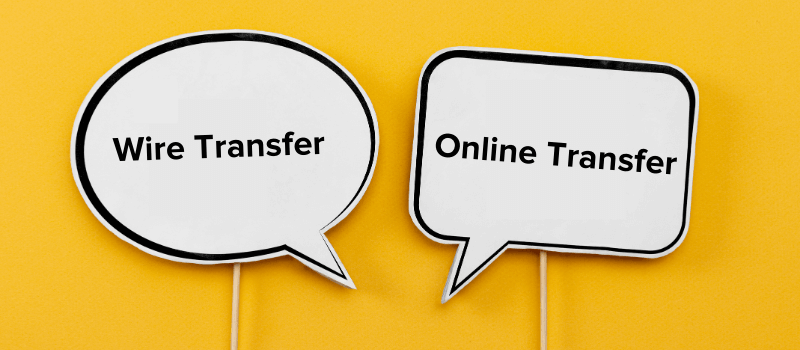

Form Cdtfa 555 St Download Fillable Pdf Or Fill Online Authorization Agreement For Electronic Funds Transfer Eft California Templateroller

What Is Electronic Funds Transfer Eft Uses And Benefits Electronics Information Communications Technology

Direct Money Transfer To India Using Click2remit

Eft Payments The Ultimate Guide

Bank Transfers All About Making International Payments

Moving Your Money Electronic Funds Transfer Forbes Advisor

Electronic Fund Transfer Act Consumer Rights Protections

Ach Vs Wire Transfers Uses Costs And Risks M T Bank

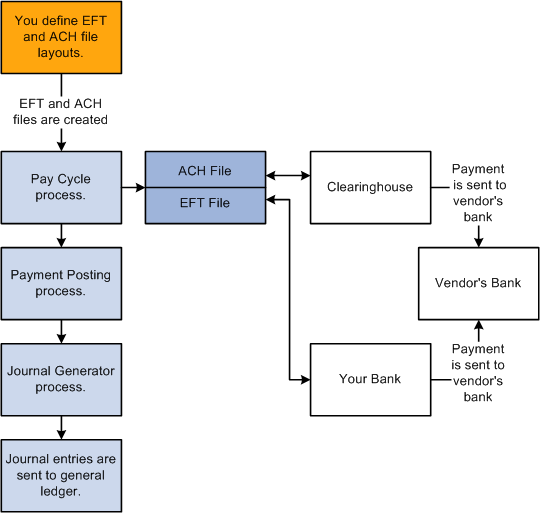

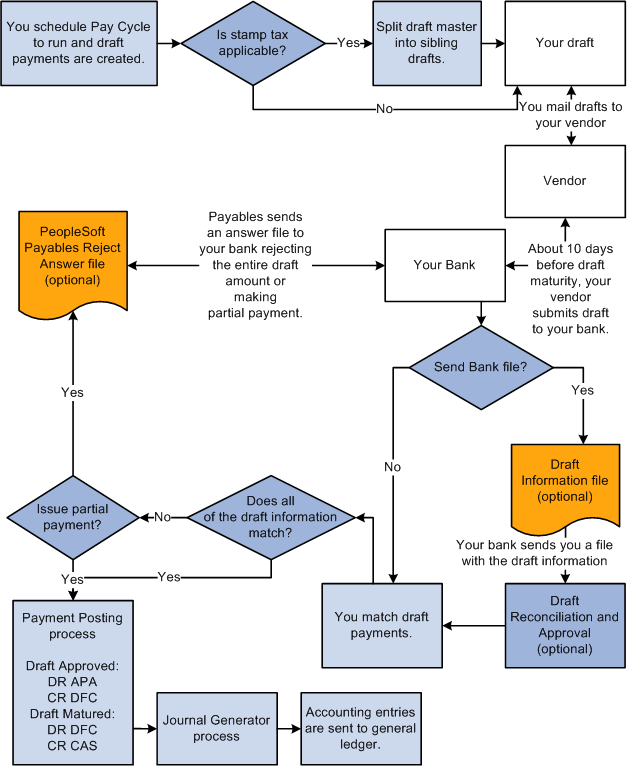

Peoplesoft Payables 9 1 Peoplebook

Difference Between Ach And Direct Debit With Table

Eft Payments The Ultimate Guide

Everything You Need To Know About Eft Payments Remitr

Peoplesoft Payables 9 1 Peoplebook

/what-does-ach-stand-for-315226_FINAL-a68079317cfb403aaa73cab72e1762ab.png)

Post a Comment for "Electronic Funds Transfer Vs Direct Debit"