Electronic Fund Transfer Risks

The person or other source initiating the request. Systems settlement fails liquidity risk.

Instant Transfers Banco De Portugal

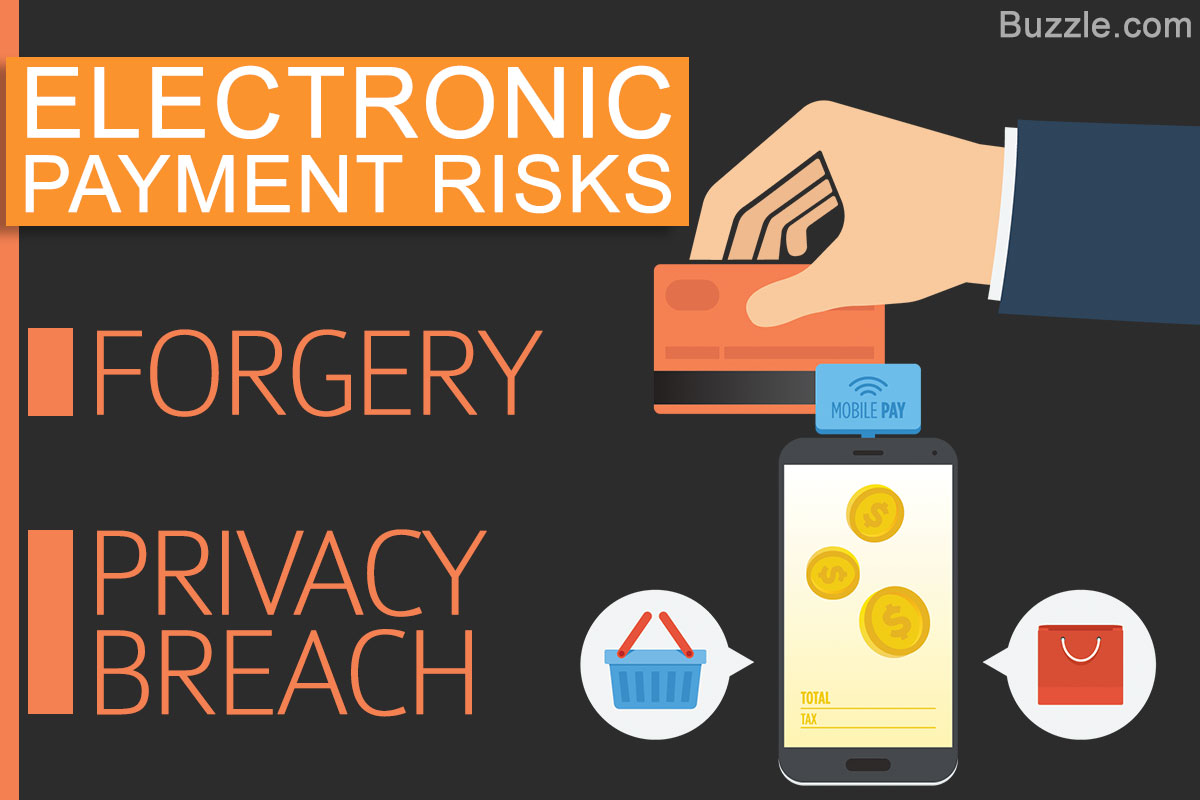

While affording convenience and speed Electronic Funds Transfer EFT also involves potentially serious security problems requiring financial institutions to take special precautions in Automated.

Electronic fund transfer risks. After the 60-day mark consumers risk losing all the money involved in the fraudulent transfer. For instance it eliminates the need to carry huge amounts of money. 03092001 Standards Associated Risks.

While there are some dangers that giv-ing these problems higher visibility through public discussion may at first make them worse the public is entitled to know what risks they are exposed to in using EFT serv-ices. So how can South African consumers and businesses continue to use instant EFT in a safe way. The amount to be transferred.

When you pay by check you make it possible for anyone who happens to see your check to obtain your bank account and routing numbers. Examination Modules 1020 The account title and number. If a customer purchases something using EFT then they must have the money available right away.

In the US an estimated 500 billion is transferred among financial institutions daily. Point-of-sale POS terminals. Authentication callbacks fax personal identification numbers.

EFT has become a predominant method of money transfer since it is a simple accessible and direct method of payment or transfer of funds. Funds transfer fraud is growing at an alarming rate affecting both financial institutions and customers of all sizes types and geographies. Electronic Fund Transfer Act The Electronic Fund Transfer Act EFTA 15 USC.

Potential fraud may be identified through transaction profiling of accounts and historical activity or through methods of communication used to initiate a transfer request. Examination Modules October 2000 Electronic Funds Transfer Risk Assessment Page. List of the Disadvantages of Electronic Funds Transfers.

Automated Clearing House Electronic Funds Transfer - covers loss to the bank arising from the debiting or crediting of a customers account on the faith of any fraudulent electronic funds transfer instructions received by the insured bank from an electronic fund transfer system of an automated clearing house eg FEDWIRE BANKWIRE CHIPS and SWIFT and purporting to have originated. ActAnti-Money Laundering Asset Quality Liquidity and Sensitivity to Market Risk. Given the growing frequency of incidents and the similarities of methods and circumstances this note will be our most prescriptive comment yet about actions.

All in all EFT transactions are far safer than writing paper checks. Customers need to have the funds available immediately. 1693 et seq of 1978 is intended to protect individual consumers engaging in electronic fund transfers EFTs and remittance transfers.

Selected ElectronicFunds Transfer Issues. These services include transfers through automated teller machines ATMs. An electronic funds transfer is a process that happens immediately.

Funds transfers represent heightened degrees of risk depending on frequency of requests dollar amount geographic risk considerations of the originator and beneficiaries and relationship of the originator or beneficiary to the financial institution. Privacy Security and Equity conventional thefts from financial institu-tions. Examiners reviewing Electronic Funds Transfer EFT have an opportunity to observe such things not all inclusive as suspicious activity loan participation activity borrowing activity brokered deposits and.

One of the big four banks recently noted that there are also significant risks for the businesses themselves that sign over their banking and client information to a third party. The statement went on to detail some of these risks such as the potential for fraud and financial crime as well as data privacy issues. One participants failure to settle could deprive other participants of the funds they need to settle systemic risk.

The time and date. Electronic Funds Transfer Risk Assessment Examination Start Date. Furthermore both law enforcement.

These transfers take place independently from bank employees. An electronic funds transfer EFT or direct deposit is a digital movement of money from one bank account to another. Electronic Data Interchange is the most prevalent method that financial institutions use to transfer funds.

A sequence number. As a digital transaction there is no need for paper documents. The statement went on to detail some of these risks such as the potential for fraud and financial crime as well as data privacy issues.

Its not like the traditional check that might take a few business days to clear before the bank releases the. One of the big four banks recently noted that there are also significant risks for the businesses themselves that sign over their banking and client information to a. An electronic funds transfer is much safer and secure.

Funds transfers may present a heightened degree of risk depending on such factors as the number and dollar volume of transactions geographic location of originators and beneficiaries and whether the originator or beneficiary is a bank customer.

Eft Payments The Ultimate Guide

:max_bytes(150000):strip_icc()/ElectronicFundTransferAdobeStock_91053116-912781d9ce5b406192b7704d0bd1e91f.jpeg)

How The Swift System Works Swift Transactions

What Is Electronic Funds Transfer Eft Payments Explained Ebanx

Moving Your Money Electronic Funds Transfer Forbes Advisor

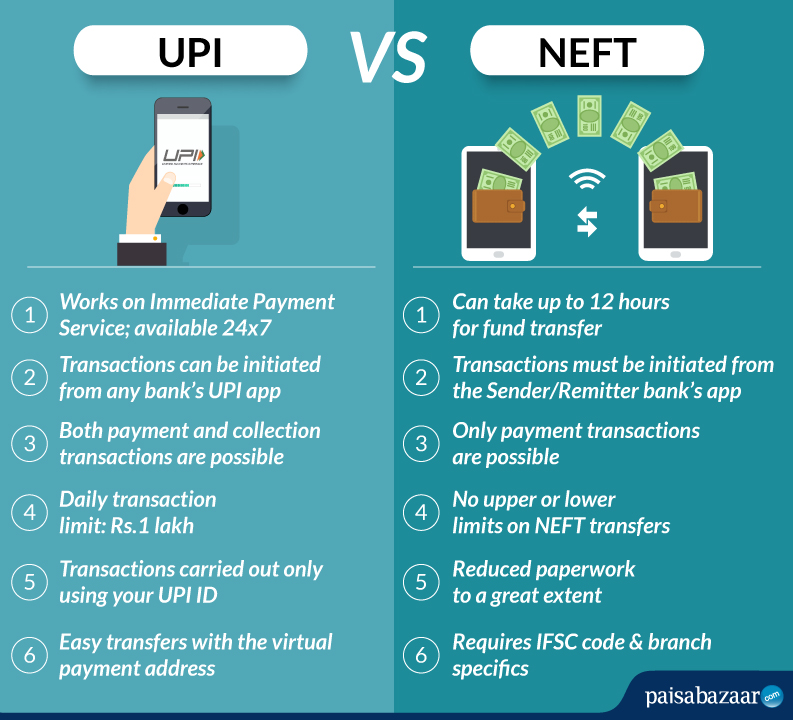

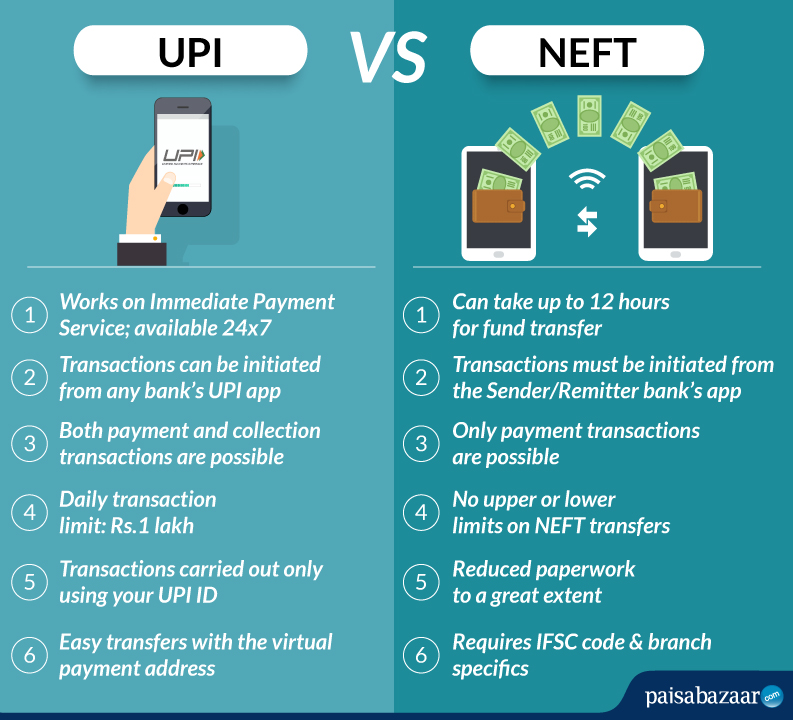

Upi Vs Neft What Are The Benefits Of Upi

How To Transfer Money For A Closing

Be Aware Of These Disadvantages Of Electronic Payment Systems Wealth How

Payment And Settlement Systems A Primer Vinod Kothari Consultants

Neft What Is Neft Neft Timings Neft Transfer Daily Limits

17 Advantages And Disadvantages Of An Electronic Funds Transfer Vittana Org

Eft Payments The Ultimate Guide

Eft Payments The Guide To Electronic Fund Transfers Avidxchange

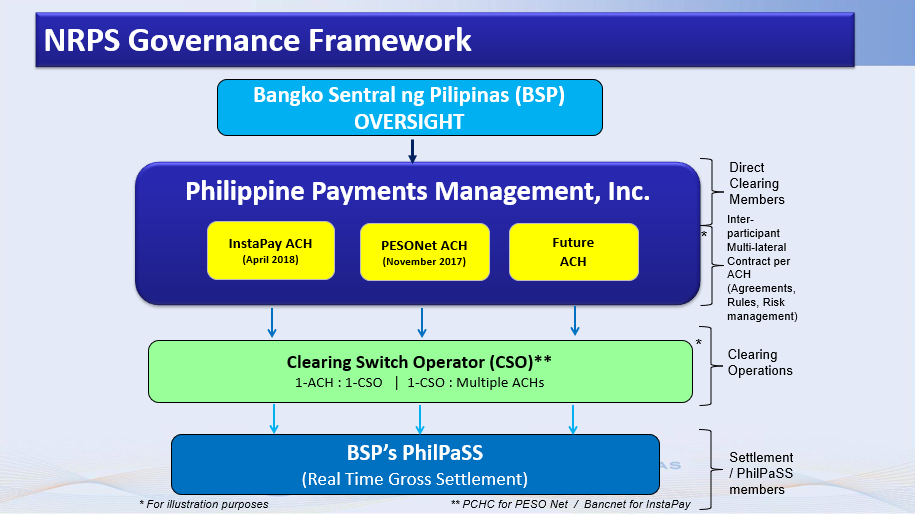

Payments And Settlements National Retail Payment System

Eft Payments The Ultimate Guide

Electronic Fund Transfer Act Consumer Rights Protections

/ATM-56a634a15f9b58b7d0e06764.jpg)

Electronic Fund Transfer Act Efta Definition

Eft Payments The Ultimate Guide

Rtgs Vs Neft Difference Between Neft Rtgs Limit Transfer Timing Snapshot

What You Need To Know About Eft Electronic Funds Transfer In Canada Apaylo Ecommerce Payment Software Canada

Post a Comment for "Electronic Fund Transfer Risks"