Electronic Funds Transfer Act Summary

The Electronic Fund Transfer Act EFTA regulates electronic funds transfers. The Electronic Funds Transfer Act EFTA is a consumer protection measure that went into law in 1978.

Electronic Code Of Federal Regulations Ecfr

Assented to 2nd November 2000 Enacted by the Parliament of Trinidad and Tobago as.

Electronic funds transfer act summary. The goal of the EFTA is to establish a set of rights and liabilities for consumers in electronic funds transfer activities as well as other responsible participants in the transfer. Electronic Fund Transfer Act The Electronic Fund Transfer Act EFTA 15 USC. These services include transfers through automated teller machines ATMs.

What is an electronic funds transfer. An EFT is a way of passing money from one person or business to another electronically. The EFTA is a federal law that protects individuals who make EFT payments.

1693 et seq of 1978 is intended to protect individual consumers engaging in electronic fund transfers EFTs and remittance transfers. ANACTto regulate the transfer of money by anelectronic terminal by use of a card for thepurpose of instructing or authorising a financialinstitution to debit or credit a cardholdersaccount when anything of value is purchased andfor other related purposes. The Electronic Funds Transfer Act EFTA was authorized by Congress in 1978 and signed into law by President Jimmy Carter.

The Electronic Fund Transfer Act is a federal law that offers consumer protections for electronically transferred funds. The Electronic Fund Transfer Act EFTA includes an anti-waiver provision stating that no writing or other agreement between a consumer and any other person may contain any provision which constitutes a waiver of any right conferred or cause of action created by EFTA 15 USC. Point-of-sale POS terminals.

These are typically banks but also include electronic wallets or accounts with separate providers. Electronic funds transfers are attractive to legitimate businesses because they generally provide a secure and trusted means of sending large amounts of money quickly. Transfers through automated teller machines ATMs.

In addition this bulletin summarizes the Consumer Financial Protection Bureaus CFPB Regulation E amendments regarding remittance transfers that became. EFT services include transfers through automated teller machines point-of-sale terminals automated clearinghouse systems. This is done by moving money between accounts held with relevant financial institutions.

For those reasons electronic funds transfers are also attractive to legitimate users as a means of sending small amounts of money quickly. Point-of-sale POS terminals. The act calls on financial institutions to disclose the terms of electronic transactions like these.

De très nombreux exemples de phrases traduites contenant electronic fund transfer Act Dictionnaire français-anglais et moteur de recherche de traductions françaises. Electronic fund transfers are defined as transactions that use computers phones or magnetic strips to authorize a financial institution to credit or debit a customers account. Although there may be circumstances where a consumer has provided actual authority to a third party under.

The examination procedures are prepared for use by OCC examiners as a supplement to the Federal Financial Institutions Examination Councils interagency Electronic Fund Transfer Act EFTA procedures that the OCC adopted in 2019. Examples include using an ATM and receiving direct deposits. In 1979 the Electronic Fund Transfer Act EFTA also known as Regulation E was implemented to protect consumers when they use electronic means to manage their finances.

The EFTA establishes your rights and liabilities as well as the liabilities of financial institutions when you engage in the electronic transfer of money. Electronic Fund Transfer Act The Electronic Fund Transfer Act EFTA 15 USC. 1693 et seq of 1978 is intended to protect individual consumers engaging in electronic fund transfers EFTs and remittance transfers.

For example the EFTA requires financial institutions to provide consumers with a summary of rights and notifications of unauthorized transactions. ELECTRONIC FUND TRANSFER ACT The Electronic Fund Transfer Act EFTA 15 USC 1693 et seq of 1978 is intended to protect individual consumers engaging in electronic fund transfers EFTs.

Electronic Fund Transfer Act What You Need To Know Credit Karma

What Is An Eft Payment Gocardless

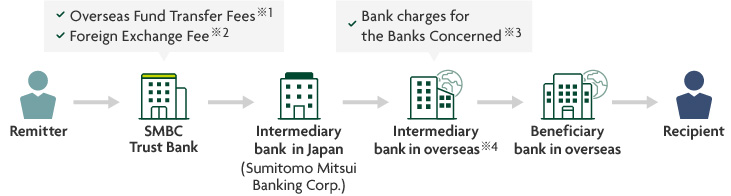

Overseas Fund Transfer Electronic Transfers Smbc Trust Bank

E Commerce Electronic Funds Transfer In E Commerce Concepts Tutorial 15 August 2021 Learn E Commerce Electronic Funds Transfer In E Commerce Concepts Tutorial 11865 Wisdom Jobs India

Https Www Jstor Org Stable 40686032

Federal Register Electronic Fund Transfers Regulation E

Electronic Fund Transfer Act Efta Definition

Electronic Fund Transfer Act Efta Overview Coverage

Electronic Fund Transfer Act Efta Definition

Electronic Fund Transfer An Overview Sciencedirect Topics

Electronic Fund Transfer Act Efta Definition

E Commerce Electronic Funds Transfer In E Commerce Concepts Tutorial 15 August 2021 Learn E Commerce Electronic Funds Transfer In E Commerce Concepts Tutorial 11865 Wisdom Jobs India

Federal Register Electronic Fund Transfers Regulation E

Niceideas Ch Dissecting Swift Message Types Involved In Payments

Electronic Fund Transfer Act Efta Definition

Electronic Code Of Federal Regulations Ecfr

Electronic Funds Transfer Eft Investinganswers

Electronic Fund Transfer Act Consumer Rights Protections

Post a Comment for "Electronic Funds Transfer Act Summary"