Electronic Banking Conclusion

Ovia 2001 argued that Electronic banking is a product of e-commerce in the field of banking. Therefore government and Bankers should attempt to introduce.

Internet Banking College Project

These software programs allowed the users personal computer to dial up the bank directly.

Electronic banking conclusion. De très nombreux exemples de phrases traduites contenant electronic banking Dictionnaire français-anglais et moteur de recherche de traductions françaises. The evolution of the e-banking industry can be traced to the early 1970s when banks began to look at these types of services as an. It has made life easier.

Demand side pressure due to increasing access to low cost electronic services. Conclusion The results show opportunity cost of lost of banks customers will reduce to use of electronic banking and also indicate non-existing of enough knowledge and trust have led to decrease in using e-banking in the world and education can increases using of electronic banking services among the banks customers in the world. Electronic banking is considered as a new revolution in the digital technology and traditional banking B.

Growing customer awareness and need for transparency. Background to the company services which implies the provision of banking Hatton National Bank HNB is a premier private products and services through electronic delivery sector commercial bank operating in Sri Lanka which channels such as the internet the telephone the cell has. Convenience- Complete your banking at your convenience in the comfort of your home.

In general conclusion the electronic banking has made banking transaction to be easier by bringing services closer to its customers hence improving banking industry performance. OTHER FORMS OF ELECTRONIC BANKING Direct Deposit Electronic Bill Payment Electronic Check Conversion Cash Value Stored Etc. Electronic banking is an activity that is not new to banks or their customers.

Jadudauonbiacke 2 Department of Finance and Accounting University of Nairobi Nairobi Kenya. Finland was the first country in the world who took a lead in E-banking. The use of information technology in banking operations is called electronic banking.

You dont have to go to the bank for transactionsInstead you can access your account any. While electronic banking can provide a number of benefits for customers and new business opportunities for banks it exacerbates traditional banking risks. 20 Objectives of the study.

Online Banking or E-based banking is also. In more recent years modern e-banking services such as internet and mobile banking has revolutionized banking services. Role of Electronic Banking in the Development of Financial Institution in Saudi Arabia Name.

The usage of E-Banking services by bank clients has grown in the past few years about 25 to 30 Bank to the Future 2013. Conclusion About E Banking Risks. 24x7 service- Bank online services is provided 24 hours a day 7 days a week and 52 weeks a year.

E-BANKING BENEFITSCONCERNS OF E-BANKING BENEFITS OF E-BANKING For Banks. Emergence of open standards for banking functionally. Conclusion About E Banking Risks Essays and Research Papers.

In particular there is. In India ICICI bank was the first bank that initiated E-banking as early as 1997 under the brand name Infinity. SUMMARY CONCLUSIONS AND RECOMMENDATION.

Conclusion Following the countries. Close integration of bank services with web based E-commerce or even disintermediation of service through direct electronic payments E-cash. 1 Department of Finance and Accounting University of Nairobi Nairobi Kenya e-mail.

Electronic banking is the use of electronic and telecommunication networks to deliver a wide range of value added products and services to bank customers S teven 2002. Global players in the fray. No more Qs- There are no queues at an online bank.

Door Step Banking Electronic Fund Transfer The three broad facilities that e-banking offers are. Electronic banking is defined as Delivery of banks services to a customer at his office or home by using Electronic technology can be termed as Electronic Banking. The Lebanese banking sector core of the Lebanese economy has been witnessing unprecedented growth especially with regard to electronic services Fakhoury Aubert 2015.

Plus its cheaper to make transactions over the Internet. Internet banking is just like normal bankingwith one big exception. Banks having been providing their services to customers electronically for years through software programs.

11 CHAPTER 2 INTRODUCTION TO E-BANKINGE-BANKING Electronic banking in simple terms means it does not involve any physicalexchange of money but its all done electronically from one account toanother using the Internet. Even though considerable work has been done in some countries in adapting banking and supervision regulations continuous vigilance and revisions will be essential as the scope of e-banking increases. Contents Abstract 3 10 Introduction 3 11 Introduction to study 3 12 Statement of the problem 4 13 Research objectives 4 14 The purpose of.

11 - 20 of 500. Table of Contents INTRODUCTION 1 RISKS POLICIES FOR THE FOUR TOP BANKS IN BOTSWANA 1 SECURITY RISK 2 OPERATIONAL RISK 2 CONTROL AND COUNTER MEASURES 4 System Architecture and design 4 Conclusion 5 BIBLOGRAPHY 6 INTRODUCTION E-banking has become a common trend here in our country. Electronic banking services have been around for quite some time in the form of automatic teller machines and telephone transactions.

Price- In the long run a bank can save on money by not paying for tellers or for managing branches. Indeed Lebanese banks are strategically. In the past however banks have been very reluctant to provide their customers with banking via the Internet due to.

To identify various e-banking.

Https Www Elibrary Imf Org Downloadpdf Journals 022 0039 003 Article A014 En Pdf

How Blockchain Is Changing Industries Blockchain Cryptocurrency Trading Technology Solutions

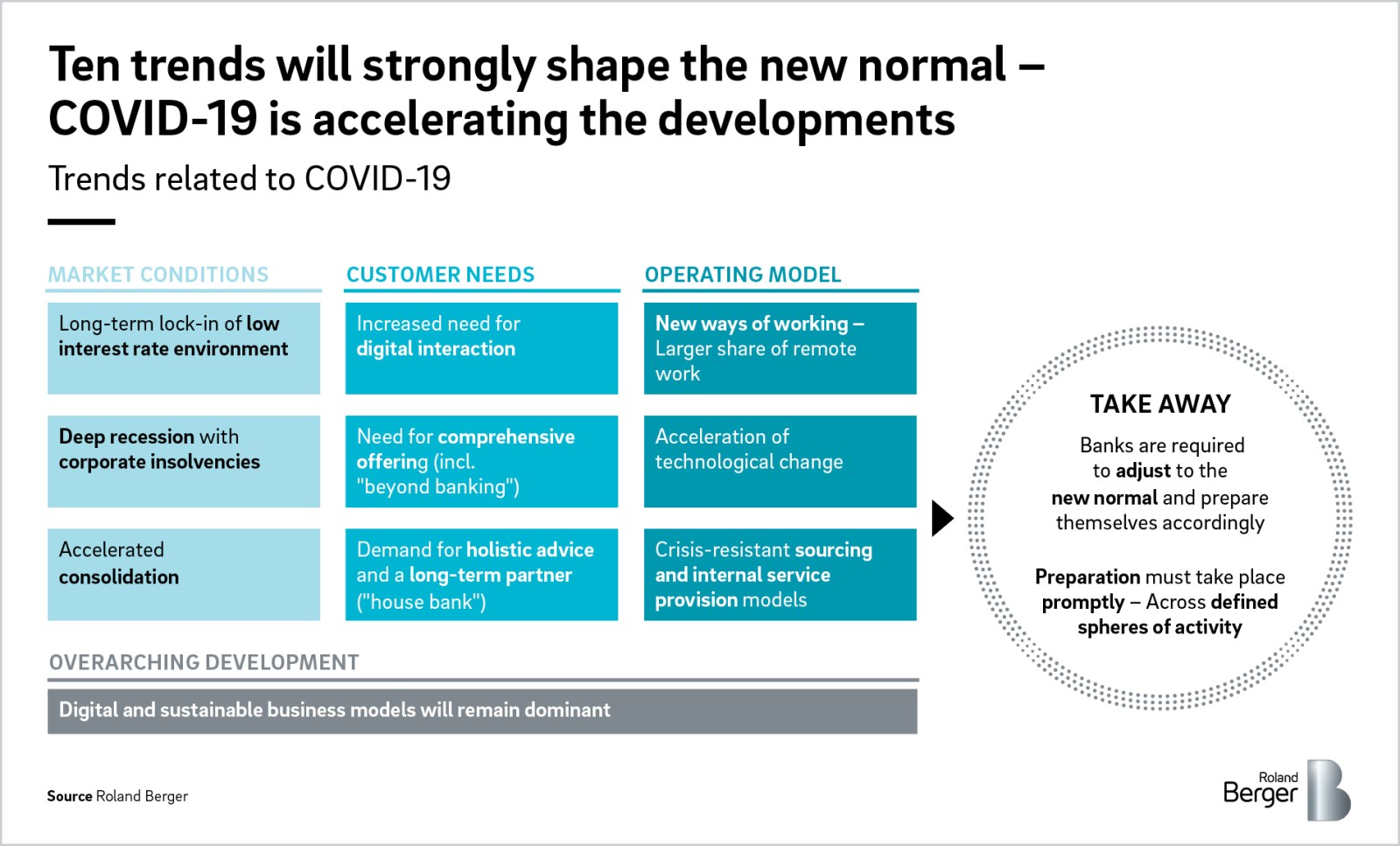

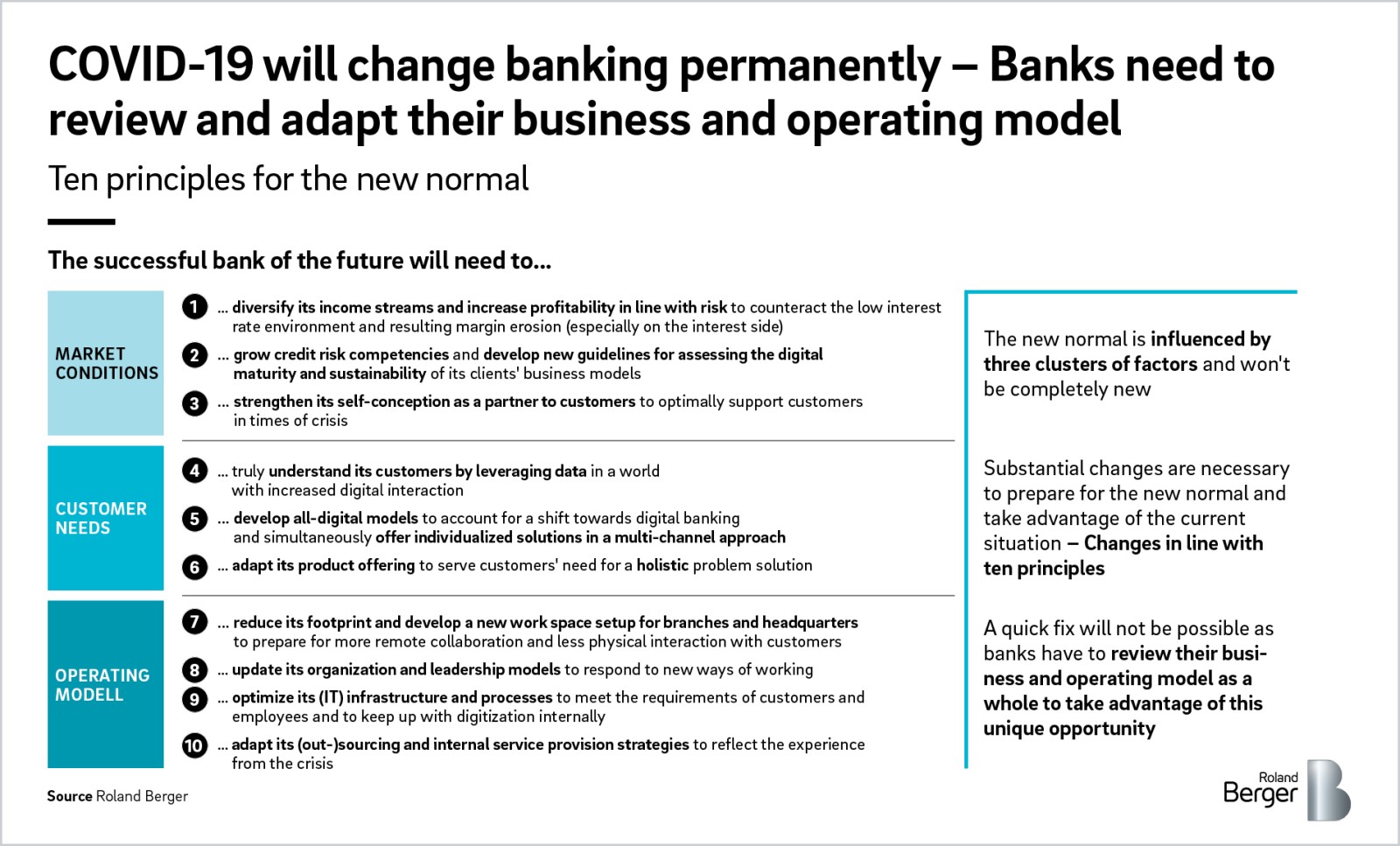

The New Normal In Banking Covid 19 As A Catalyst For Existing Trends Roland Berger

What Is Loan Refinance What Are The Benefits Of Refinancing Refined Loan Refinance Mortgage

Pdf Effect Of E Banking On Financial Performance Of Listed Commercial Banks In Kenya

Bank Of Baroda Cash Withdrawal Form Fill Up With Live Demo In 2021 Bank Of Baroda Baroda Bank

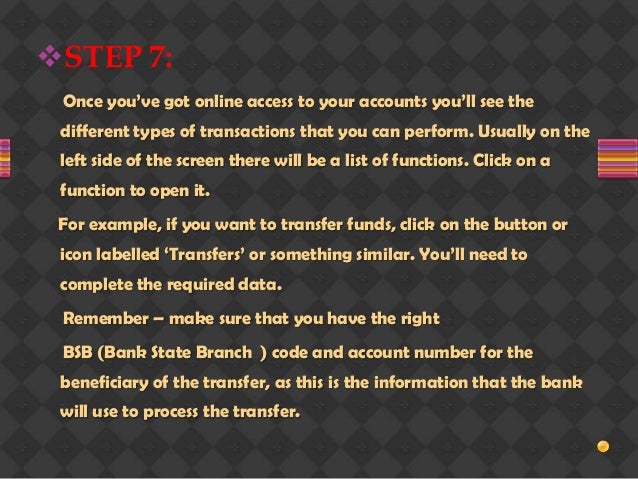

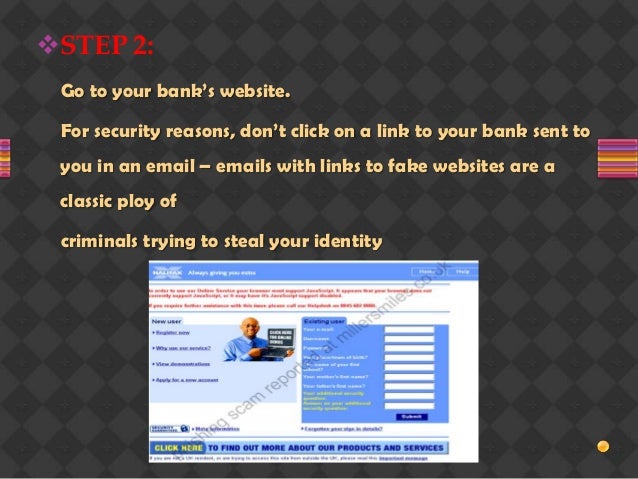

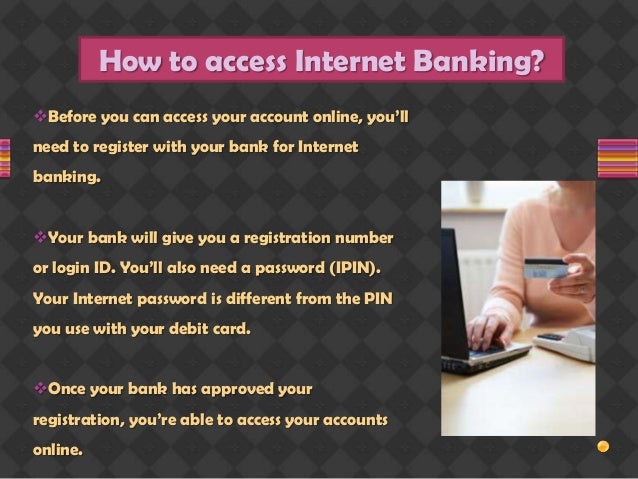

Internet Banking College Project

Pdf Electronic Banking Strategies And Their Impact On Customers Satisfaction Empirical Evidence From Palestine

Vector Flat Illustration Banking Electronic Mobile Payment Payment Notification Large Tablet With Che Mobile Payments Leadership Workshop Flat Illustration

Http Www Ipedr Com Vol43 013 Icfme2012 M00033 Pdf

The New Normal In Banking Covid 19 As A Catalyst For Existing Trends Roland Berger

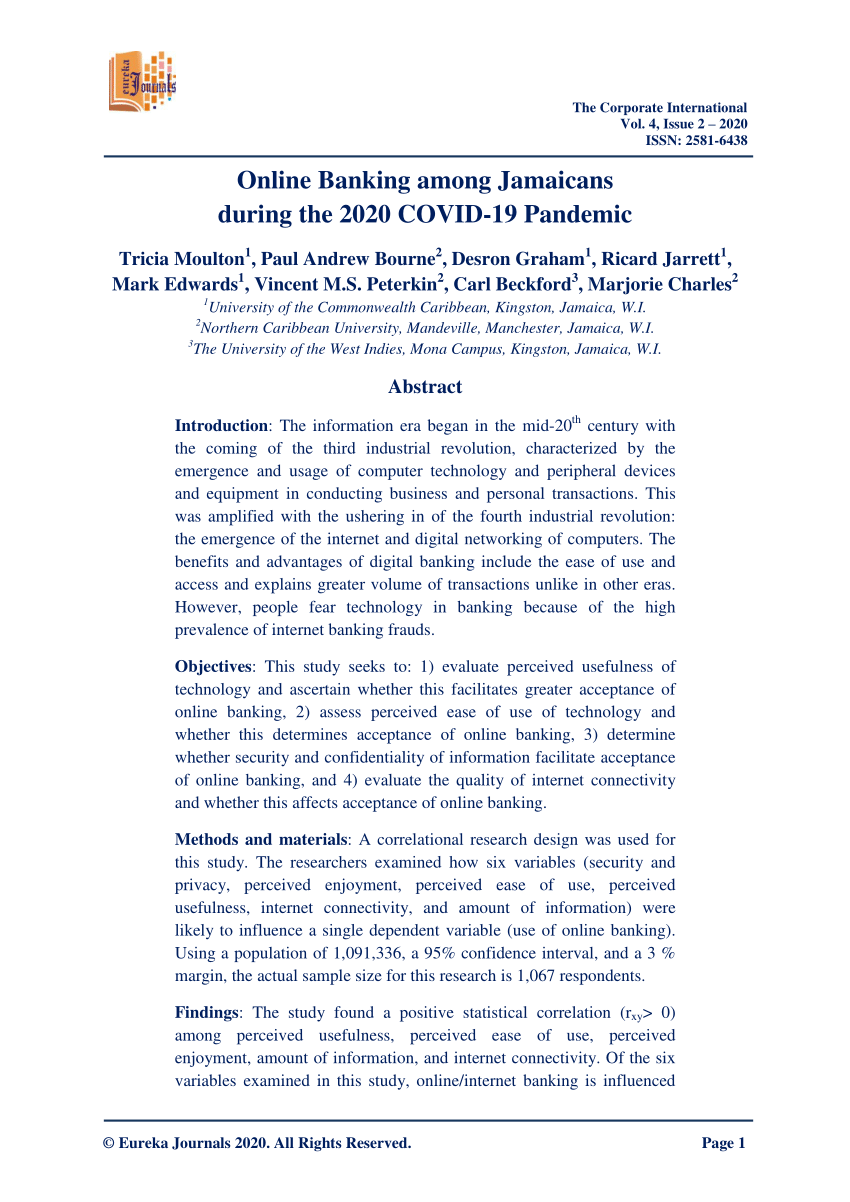

Pdf Online Banking Among Jamaicans During The 2020 Covid 19 Pandemic

Internet Banking College Project

Pdf An Investigation On Online Banking Adoption

Internet Banking College Project

Pin On Bank Exams Preparation Sbi Po Ibps Clerk

Bitcoin Conclusion Book Marketing Bitcoin Peer

Uba Secure Pass How To Setup Download Activate And Create Token Pin Uba Banking App Token

Post a Comment for "Electronic Banking Conclusion"